Where we invest our money shapes the world around us. It has long-lasting effects. Marrying principles to profit has led to the rise of ethical investment, with investors now able to align their values with the companies and ideas they are backing.

What is conscious investing?

Conscious investing takes this concept a step further, with investors seeking to fund assets that create positive social or environmental impact while still providing substantial financial gain. Here are my three tips to help investors begin their journey to becoming more conscious, and it all starts with doing the research.

1. Research the values of the business you’re backing

Ideally, you will already be doing a significant amount of research into the performance of any business you are considering investing in. Conscious investment requires digging a bit deeper to clearly analyse the scope of the opportunity.

A company’s values can be indicative of a myriad of things; including how they treat their staff, if they practice responsible sourcing in their supply chain and what kind of social and environmental commitments they’ve made – without being prompted by industry or government regulators.

While company websites are a good place to start, it’s worth seeking out media interviews and appearances made by a business’ management team to see how they demonstrate their values in the public domain.

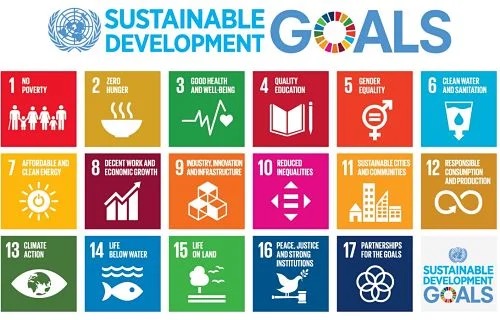

You can use the UN’s Sustainable Development Goals as a guide to assess the purpose of our investment opportunities and partnerships. These 17 goals are a call to action for all countries to promote prosperity while protecting humanity and the planet. It may sound like a tall order, but we believe that if every venture opportunity on offer addressed these goals in some way, then we are collectively working towards the betterment of the entire world.

2. Invest in businesses that focus on sustainability

Business leaders who claim that profitability and sustainability cannot go hand-in-hand may have a flawed rationale. There are many new ventures out there that are creating innovative solutions to social and environmental issues such as global warming and renewable energy.

Wave Swell Energy is one such venture. The company has developed world-leading proprietary technology that converts wave energy into electrical energy and is currently operational on King Island, Tasmania. The technology produces clean, sustainable energy without the use of oil or other contaminants, thanks to waves being a naturally occurring, infinite resource.

Wave Swell’s operation of their business directly hit on goal 7 of the UN’s Sustainable Developmental Goals – ‘Affordable and Clean Energy’. Not only are waves an excellent source of renewable energy, wave energy is also climate change adaptive. As climate change continues, sea levels will rise and so will storm events, ultimately creating more waves and more energy.

3. Partner with those that give back

The events of 2020 have highlighted that we all, as human beings, have a responsibility to help one another, and it is important that this responsibility is carried out at an individual and business level.

Seek out businesses that give back to their communities in one form or another; be that through money, time, empowerment or education. Many organisations contribute to charity as part of their corporate social responsibility initiatives, however it is crucial that the organisation’s investors choose to support hold the same values and take action on these values in a meaningful way.

You may want to support organisations that fund new futures and solve global problems. For example, business that partner with organisation like The Smith Family. This Australian charity that works to solve the issue of childhood poverty by equipping children with the education they need to build better futures for themselves.

The Smith Family’s operations touch on goal 1 and goal 4 of the UN’s Sustainable Development Goals: ‘No Poverty’ and ‘Quality Education’. The charity’s Kidpreneur program also guides primary school children through building their very own microbusiness. If we can ensure that Australian children are taught how to think with this kind of creative mindset at an early age, then Australia as a whole will be reaping the rewards for decades to come.

Understanding what’s important to you is the key to conscious investing

Conscious investment is a deeply personal endeavour, and investors should take the time to ensure that the companies they want to support align with their core values. Having a strong sense of self as an investor is vital, as is a solid understanding of the values that you hold. By learning what type of investor you’d like to be, and completing thorough research, you should be able to navigate your way through this new frontier of responsible investment.

By Steve Maarbani, CEO of VentureCrowd, Australia’s leading equity crowdfunding platform with over 42,000 registered members; offering curated investment opportunities in high-growth private companies, diversified property development funds, property development projects and alternative credit.

This article was first published by Canstar